Calculate sustainable monthly withdrawals from your index fund portfolio while accounting for market volatility, taxes, and ensuring your funds last

Your passive income results will expand

No sign-up required

Financial Freedom with Index Funds

Join millions who've discovered the simple, proven path to financial independence

Start Investing in 3 Simple Steps

Get started in under 5 minutes

Step 1: Create Your Account

Sign up for a a broker account

Step 2: Fund Your Account

Transfer money securely from your bank account

Step 3: Start Investing

Buy your first index fund share from just $1

Ready to Start Investing?

Start building your wealth today with as little as $1.

Get a Wise account in minutes to start investing.

What are Index Funds?

Index funds are a basket of stocks that mirror a market index like the S&P 500. Instead of betting on individual companies, you own a piece of the entire market.

Why Index Funds Win

Diversified Safety

Spread risk across thousands of companies. If one fails, your portfolio barely notices.

Ultra-Low Fees

Pay 0.60% vs 1-2% for managed funds. Save thousands in fees over your lifetime.

Proven Performance

92% of fund managers fail to beat index funds over 15 years. Why pay more for less?

Zero Stress

No research, no timing, no watching charts. Set it and forget it investing.

Time-Tested

13.6% average returns over 30+ years. History shows patience pays off.

Beat Day Traders

80% of day traders lose money. Average loss: -36% annually. Don't gamble, invest.

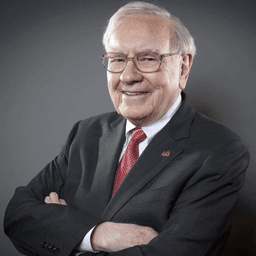

“A low-cost index fund is the most sensible equity investment for the great majority of investors.”Warren Buffett•CEO of Berkshire Hathaway

The Power of Patient Investing

Why Choose Wise Stocks?

The smarter way to invest in index funds

0.60% Total Annual Fee

Keep more of your returns. Traditional brokers charge 1-2% or more.

Global Portfolio

MSCI World Index with 1,600+ companies across 23 countries.

40+ Currencies

Hold and convert at real exchange rates. No hidden markups.

Full Transparency

No hidden fees, no surprises. See exactly what you pay.

16M+ Users

Part of Wise, trusted by millions worldwide since 2011.

Start from £1

No minimum investment. Start small and grow over time.

Last 5-year performance

Wise returns after all fees have been deducted

Data for 2024 isn't available yet due to audit and regulatory processes. BlackRock finalizes data in January, Wise translates it to all currencies and updates disclosures, then regulatory filings are completed – typically making it available by late summer.

This graph shows yearly changes to growth in GBP. This is based on conversion from Euros to GBP using the historic mid-market rate. Past performance doesn't guarantee future growth.

Top companies in the fund

This fund invests in all the companies that MSCI World Index tracks. So your investment will go up and down depending on how these collection of companies perform.

Fund details

Start Building Your Future Today

Join millions who've chosen the simple path to wealth.

Start investing in your future with just $1.

Frequently Asked Questions

Everything you need to know about index fund investing

Yes, you have full access to your money whenever you need it. With Wise, you can sell your index fund shares any business day and typically have the cash available in your Wise account within 2-3 business days. There are no lock-in periods, no exit fees, and no penalties for withdrawing - you simply sell the number of shares you need. The process is straightforward: log into your Wise account, go to your investments, choose how much to sell, and confirm. However, while you CAN access your money anytime, index fund investing works best as a long-term strategy. Selling during market downturns locks in losses, and frequent trading can trigger unnecessary taxes. Think of it like a fruit tree - you can cut it down anytime for wood, but if you wait, it will provide fruit for decades. Most successful investors only sell shares when they truly need the money, letting the rest continue growing.

With Wise, you can start investing with as little as £1, which is revolutionary compared to traditional brokers that often require £500-5,000 minimums. Most successful investors start small - typically £50-200 per month - and gradually increase their contributions as their income grows. The beauty of index fund investing is that time in the market beats timing the market. Starting with £100/month at age 25 can grow to over £500,000 by retirement, thanks to compound interest. The key is to start now with whatever you can afford, even if it feels small. Every journey begins with a single step, and every fortune begins with a single £.

Index funds are considered one of the safest long-term investment options available, but it's important to understand both the safety features and risks. Your money is protected in several ways: First, you own actual shares in hundreds or thousands of companies, not just a promise from a bank. Second, these assets are held by a regulated custodian, separate from Wise, meaning your investments are safe even if Wise encountered problems. Third, diversification across so many companies means if one or even several companies fail, it barely impacts your overall portfolio - typically less than 0.1%. However, there are risks: Market volatility means your investment value will fluctuate, sometimes dramatically in the short term. During the 2008 crisis, markets dropped 40%, but recovered and went on to new highs. The key is not to panic sell during downturns. Inflation risk means leaving money in savings accounts actually loses purchasing power over time. Currency risk exists if investing internationally. But historically, patient index fund investors have been rewarded handsomely for accepting these short-term risks.

Your investments are protected by multiple layers of security. First and crucially, your index fund shares are not owned by Wise - they're held in your name by an independent, regulated custodian (State Street). This is called "segregated custody" and means your assets are completely separate from Wise's business. If Wise ceased operations, your shares would remain safely in custody and could be transferred to another broker. Second, Wise is regulated by financial authorities in multiple countries and must maintain strict capital requirements and segregate client assets. Third, in many jurisdictions, investment accounts have additional protection schemes (like SIPC in the US, FSCS in the UK) that provide insurance up to certain limits. The fund itself (Vanguard MSCI World) would continue operating regardless of what happens to Wise - it has over $100 billion in assets and multiple distributors. In the worst case, you might experience some inconvenience in transferring your account, but your actual investment would remain safe. This structure has protected investors through numerous broker failures over decades.

Market timing is one of the most costly mistakes investors make. Studies show that even professional fund managers can't consistently time the market - about 92% fail to beat index funds over 15 years. Here's why timing doesn't work: The best and worst trading days often cluster together during volatile periods. Miss just the 10 best days over 20 years and your returns drop by 50%. The market is forward-looking - by the time bad news is public, it's already priced in. "Time in the market beats timing the market" isn't just a saying - it's mathematically proven. Instead of timing, use "dollar cost averaging" - invest the same amount regularly regardless of market conditions. When markets are high, you buy fewer shares. When low, you buy more. Over time, this averages out and removes emotion from investing. The best time to invest was 20 years ago. The second-best time is now. Markets hit new all-time highs regularly - waiting for a "dip" often means missing gains while your money sits idle.

Index funds and ETFs (Exchange-Traded Funds) are similar but have key differences. Both track market indices and offer instant diversification, but: ETFs trade on stock exchanges like individual stocks - you can buy/sell throughout the trading day at fluctuating prices. Index funds trade once daily after markets close at a fixed price. ETFs often have slightly lower fees but require you to pay trading commissions and deal with "bid-ask spreads" (the difference between buying and selling prices). Wise's index fund has no trading costs. ETFs can be more tax-efficient in some countries but require more sophistication to trade effectively. Index funds are simpler - you just invest your money and forget about it. For most long-term investors, especially beginners, index funds are superior due to their simplicity and lack of temptation to day-trade. The behavioral advantage of index funds - making it easier to "set and forget" - often outweighs any minor fee advantages of ETFs. Wise chose to offer index funds specifically because they align with long-term wealth building.

Important Notice: WiseSlug provides educational content and hypothetical investment scenarios for informational purposes only. The projections, calculations, and graphs presented on this website are based on theoretical models and historical data, designed to help users understand investment concepts and potential outcomes. WiseSlug does not provide personalized financial advice, guarantee investment returns, or make promises about future performance. Past performance does not guarantee future results, and all investments carry inherent risks including the potential loss of principal. Users should consult with qualified financial advisors and conduct their own due diligence before making any investment decisions. The information provided here should not be considered as a recommendation to buy, sell, or hold any particular investment or security.